December 11

Disclaimer: This is an edited script of an article already posted by Kudosbay酷豆湾

Foreigners that are legally working in China need to pay tax in China. If you are holding a second job or are working illegally and that company deducts tax, you have no grounds to complain about it because you would be turning yourself in for doing something you’re not supposed to do.

While many people have a second job, according to law, one is only allowed one job which is with the company tied with their work permit and residence permit visa. Different officers will consider a second job differently. Locally, some will simply think if one is holding a work visa, it is fine, while others will act according to the way the law is written.

The same is true for “Green Card” or Chinese Permanent Residency Card holders. Technically, according to the national laws, if you did not obtain your status due to work (e.g. you obtained it through marriage), you are not allowed to work and working would still require a work permit; however, locally some officers will consider it okay to work, while others will not.

Below please find the tax brackets for China. The first 4,800 RMB of income earned per month is tax-free for foreigners.

How to Calculate Salary Income Tax in China:

Taxable income = Gross Income – 4,800 RMB

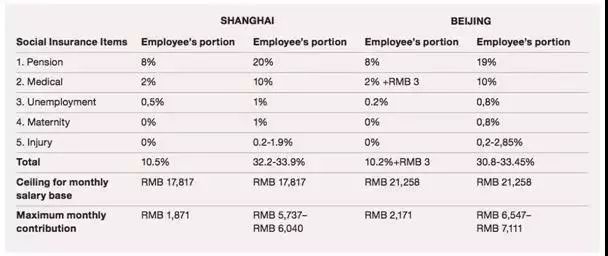

Besides tax, social insurance is the other deduction that employers are required to deduct from your salary. The amount varies according to the specific location, so we are listing here two deductions for reference: Shanghai and Beijing

Image via Burden Legal / PwC

If you are outside of these two places, you can find out the social security deductions by asking your employer as they are submitting the payments to the government. You can check the local deductions and social security paid by taking your passport to the local (district level) social security office. The same is true to verify tax information or taxes paid with the local (district level) tax office.

Please note that the social security contributions have been made mandatory in Beijing since October 2011 and were rolled out nationally at this time, while other cities and provinces were given freedom on how and when to implement the policy. At the moment it is not mandatory in Shanghai.

Currency Exchange

Before we begin this topic, we must mention for this purpose “a day” is usually considered a 24-hour interval of time.

It is important to remember that the currency exchange is extremely controlled in China.

The daily limit for exchanges out of RMB for foreign individuals without additional documents except for a passport is $500, up to an annual limit of $50,000 or equivalent amounts for other major currencies.

Also, the government recently announced an annual limit of 100,000 RMB of funds that can be withdrawn from a foreign ATM overseas with a UnionPay card. The money and fees are directly debited in RMB and vary by country and foreign bank where you are withdrawing the funds.

Due to the tightening of currency exchanges and a lack of knowledge by many bank officers relating to the laws for foreigners some may claim that this $500 or equivalent in other major currencies is not allowed. You may have to take further action for the teller to complete your transaction such as questioning for the policy document, calling the bank’s English hotline and asking the agent to talk with the bank, or talking with the branch manager.

In the past you could hold multiple accounts and “get away” with withdrawing 100,000 RMB on each card overseas; however, these days it is tied with one’s passport or identification, so the 100,000 RMB can be taken from one card or divided by many. If you are caught for having withdrawn more than the 100,000 RMB overseas then any account bearing your identification credentials will have a withdraw freeze for more than two years.

You can exchange more than $500 per day if you are legally working in China (holding a work permit and residence permit) and the bank will require the following documents. We have heard that some banks require it to be done at the bank where your employer pays the salary. In other cases, it doesn’t matter.

1. Passport

2. Residence Permit

3. Work Permit

4. Salary certificate stamped with company chop

5. Tax receipts of the last three months

If you are looking to exchange more than the annual $50,000 for amounts earned legally, there is a process through the State Administration of Foreign Exchange (SAFE), but the issue is that there is no guarantee you will be approved. It is important to note that you would likely be asked to prove all relating documents.

For example, if you made a large investment that is beyond your salary into China. You would likely need to prove how you got the money in and approved legally, the contracts and other details for the investment, etc and that it all would have to be in your name.

According to SAFE, the $50,000 or equivalent applies for both foreign exchange to and from RMB. With this said, exchanges from foreign currency to RMB is much easier. Once the money arrives at your bank account, you just need to go to the bank to exchange the funds. Depending on the type of visa that you hold you may be subject to further questioning and declined the release of funds or the funds may be returned to the sender with a fee deducted. You can ask at any Chinese bank how much money you exchanged toward your annual $50,000 limit. Should you decide to go through a Chinese friend for this, this could raise questions depending on his or her taxable salary or usual activity, etc.

Some people have indicated that they “know someone” who can obtain major foreign currencies for them, but the problem with this is proof of funds when you want to send the money overseas. If you just show up with the foreign currency, there is a high probability you will be questioned to prove the exchange or source of funds. Even if you can obtain the proof it is not tied with your name.

Transfer funds out of China

Western Union, AliPay, bank transfer, PayPal, and carrying cash out of the country are common ways to get money out of China.

The disadvantages with Western Union are as follows:

-

Can only be done in USD, but if the destination is not in the US the money usually has to be accepted in local currency (so this would mean a double exchange)

-

Cannot be transferred to a bank account overseas (e.g. someone has to pick up the cash)

-

Too many transactions or too much money involved could result in your activity being flagged and returned to you as a result of governments being concerned about money laundering

-

Many Western Union locations overseas are supermarkets or other shops or small restaurants and may not have enough cash if you make a relatively large transfer payment

AliPay foreign transfers can only be done by Chinese nationals or foreigners who are Green Card holders. While many foreigners practice this option by asking help from a Chinese friend, you will face problems if your Chinese friend is questioned about why they are sending you the money, and/or if it’s counted against their salary (e.g. if they make a certain amount of taxed income and how they can transfer so much relative to their salary).

The number of times the transactions are done, and the amounts could flag your transactions, as well. We know from experience that opening a frozen bank account is difficult enough, but opening a frozen virtual wallet must be even worse. It is not proven that Green Card holders are in practice allowed to do this. As we know from other benefits for Green Card holders that are not implemented, this could be the same, if the systems are not designed for it.

Bank transfers fees which are higher than AliPay and Western Union but is the safest option. Some of the fees are fixed per transaction, while others are a percentage of the amount sent. If you are using a Chinese friend’s help on your behalf, you risk the same questioning as mentioned for AliPay. We have heard that some Chinese banks are starting to contact the bank overseas to ensure that the account information you provide is an actual account at their bank and that it is indeed your account or you may have to provide a reason why you would need to transfer to someone else.

PayPal is another option that is often considered. however, this option is expensive and cumbersome because you need to have an account with Chinese PayPal and you use your foreign PayPal account to request the money from your Chinese PayPal account since you cannot hold the foreign currency in your Chinese PayPal account. The RMB will be deducted from your UnionPay debit card and then sent to your foreign PayPal account in foreign currency minus the fees, at the prevailing exchange rate. This still applies toward your $50,000 maximum and fees are high.

Some people prefer to carry cash out of the country if they will travel anyway. This is risky in case something happens to you or your bags. The limits for passengers leaving China are 20,000 RMB or $5,000 (or equivalent in another currency). While it does not matter which visa the traveller holds, if it seems strange, then the passenger may be questioned. For example, if a tourist is carrying a relatively high amount out then they may be questioned and the traveller could also be questioned for the relating paperwork to how the money was earned or exchanged.

If the foreign currency amount exceeds $5,000 and up to $10,000, then you will be required to provide a “Permit for Taking Foreign Currency Out of the Customs Territory” that can be issued by the bank where you did the exchange. If the amount exceeds $10,000 then you will need to show a legal warrant issued by SAFE.

While many people have exited China with more money than the mentioned amounts without the extra paperwork, you do risk confiscation of the funds, if you are caught. You would then need to obtain the documents and prove them to possibly obtain your funds back. There is a chance that further fees and consequences could apply or you may lose the funds, as technically you broke the law.

Share your opinion

Leave a comment below!

Source: Kudosbay酷豆湾

Visit us:

ExpatRights.org

AZTraders

Branded & Non-branded goods,

delivered to 152 countries

AZTradersShoes

All kinds of Branded Shoes are available at factory prices. Quality is assured.

SKY IPTV

1000s of Foreign TV Channels

“How I Fucked Up My Dating Life Teaching Abroad”

Applying for a “Chinese Green Card” with a Chinese Spouse

Getting Married In China: NOT EASY

Nationality of your Child Born In China

Support us! Tap that Wow button ⬇

原文始发于微信公众号(ExpatRights):